Over the years I’ve used a few different ways to manage my money while travelling from, cash, travellers cheques, debit card, credit cards and travel cards, but its just recently that travel cards seem to have made a real step forward becoming online only banks offering current accounts, joint accounts, giving the high street banks a run for their money as they offer much better conversion rates and even interest.

For my latest trip it was the first time I actually went away with no cash and only carried the pre loaded plastic Starling & Revolut. Though i would say it would depend on the destination it may be a good idea to have some of the local currency for when you arrive for snacks and a taxi or you may have to wander around looking for an atm. Luckily I didn’t have this problem as I was in Bangkok and could order an Uber on my phone.

Choosing the right card for your travels can potentially save you extra spending money. Currency conversion fees, initial card fees, purchase fees and ATM fees can eat away at your hard-earned travel savings while you’re off gallivanting, leaving you with less money to make the most out of your trip. With cash and travellers cheques fast becoming a thing of the past for overseas spenders, the three main ways of spending money overseas are via travel money cards, credit cards and debit cards.

Why use a travel card?

A travel card is a type of prepaid card which allows you to make transactions abroad without expensive fees or charges. If you use a rewards credit card or debit card while travelling, you will likely incur a fee of 3% on everything you purchase. Using a travel card avoids this as you can pre-load them with your currency and you can then use them for your holiday spending anywhere in the world, across multiple currencies.

With a travel card there is usually no credit facility, so you can only ever spend what’s preloaded onto it and you can’t get into debt. You have total control of your card via an app on your phone. This means prepaid cards are also safer than debit and credit cards as should someone steal your wallet and get hold of your card, they’d only be able to spend the amount on it, but if your quick to realise you can even stop that by freezing the card using the app. You can then decide to unfreeze it if your lucky enough to find it again or order a new card.

The currency loaded onto the card and when you choose to withdraw is always fixed at that day’s Mastercard exchange rate which is the best you can get.

How does it work?

It’s quick and easy to set up, you’ll be up and running within about 10 mins. Seriously it’s that easy. You will need to download the app and verify the account with your phone number. You can then start adding money from your bank account or using a credit card (Mastercard or VISA).

You will need to verify your identity with your passport, driving licence or ID card and may have to record a short video saying a specific sentence.

If you want a physical card, if you’re planning to use it for payments abroad you will, you can order one via the app. You usually have to deposit £5 into the account, which you will be able to spend once you have the card. Once you’re all set up you’ll be given a virtual card which you can start using right away via Google, Apple or Samsung Pay, but your physical card will arrive within a few days anyway.

As of July 2018 Revolut doesn’t support Apple or Google pay, so you will have to wait for the card.

Is it safe?

For me Starling wins this one as it is all fully regulated in the UK and is protected by the Financial Services Compensation Scheme (FSCS) so your deposits are protected up to £85,000 – which is the same as most ‘traditional’ UK banks. So you can rest easy. Starling won ‘Best British Bank’ and ‘Best Current Account Provider’ in the 2018 British Bank Awards.

Revolut funds are stored in either a Barclays or Lloyds account depending on the type of account you hold.

Both support fingerprint login and all transactions are protected by Mastercard or Visa rules.

Is it user Friendly?

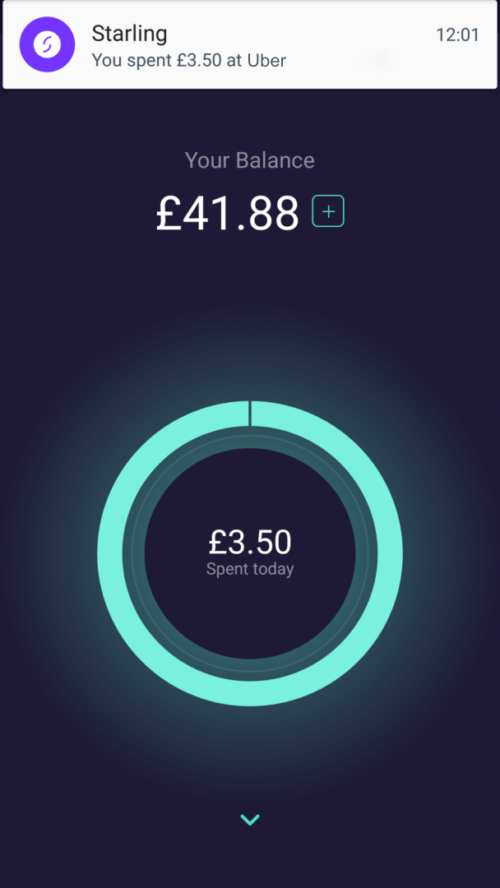

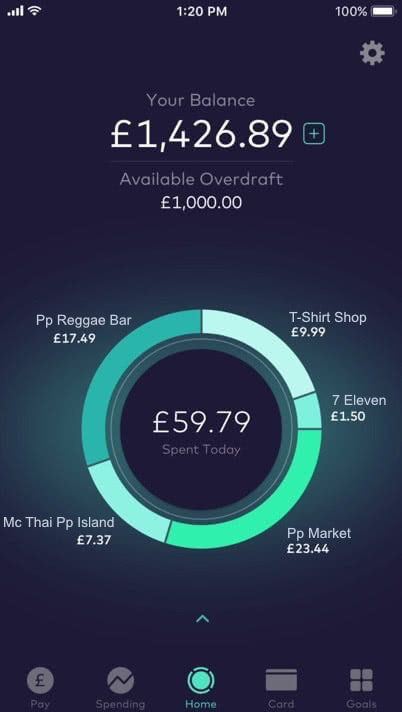

Yes, both apps are so easy to use I would call this a draw. They both have awesome features built in to help you manage your money both at home and abroad. Both apps are smooth, easy and designed to help you get what you need done quickly and easily. The home screens of both apps contain two key pieces of information – the balance of your account and how much you’ve spent today. Two very important pieces of info and the basics of what most people need to know – whether you’re at home or travelling! You can even dive in further with analytics where your spending is categorised to travel, hotels, groceries, shopping, eating out – to the individual businesses you’re spending your cash at. They both give you a handy overview of how much you’ve spent over the month and even as a percentage of your overall spending. If like me your a fan of 2am ham and cheese toasties at 7/11 in Thailand, you’ll quickly be able to see how much those midnight munchies are racking up a month!

What’s the biggest advantage?

The fact they have zero fees abroad. Yup zero, as in 0, nada, nothing. They won’t charge you for taking out cash abroad (admittedly if the cash machine charges you’ll have to pay that, but that’s almost impossible to avoid) and using it to pay by card for things abroad is also fee free.

You’ll get the live MasterCard exchange rates when spending abroad. Which basically means they aren’t ripping you off with a terrible exchange rate.

Tracking your spending – the apps display your expenses in both the local currency and your home currency.

Your able to freeze and unfreeze your own card (if you misplace it!) as well as real-time notifications about what you’ve spent in both pounds and foreign currency, so you’re always in the loop. This means if someone clones your card you’ll instantly know about it and there’s a 24/7 live chat built right into the app, so if you have any issues you won’t be on hold for hours!

They help you with your saving to, Starling has ‘Goals’, Revolut has ‘Vaults’. Both allow you to put money into a seperate part of your account as recurring or deposit. If you do find yourself needing to dip into your savings pot you can quickly and easily transfer it back into your main account with either card.

What limits are there?

Revolut is only free to withdraw up to £200 per month from an ATM, you then pay 2% after that (£400 if you have the Premium card, but I don’t think premium is worth it) Also if you withdraw on a weekend (Friday 00:00 – Sunday 23:59), they will charge you a small markup to protect the company from potential losses due to any large fluctuation in the rate, so only withdraw Monday to Thursday.

Sterling you can make six withdrawals a day with a max withdrawal of £300 a day, everyday with no charges.

Sterling is the clear winner here, If you need to withdraw cash frequently revolut’s monthly allowance is shocking, Starling would be the better option.

Withdrawing cash

I was travelling around Thailand and found Revolut worked only for certain atms, on two occasions I tried it didn’t work and I had to find another atm.

Starling I had no such problems I withdrew 5 times and it worked every time.

Sometimes when you use an ATM, you will be asked to choose between a ‘credit’, ‘checking’ or ‘savings’ account. You should always choose either a ‘checking’ or ‘savings’ account. I always chose checking and this worked for me.

It’s always best to withdraw the maximum you can as you can’t avoid atm charges. If you only withdraw small amounts its more expensive, say you withdraw £100 at a time and your charged a £3 fee, that will amount to £9 in fees for every £300 you withdraw, so you should always withdraw the maximum amount. With Starling thats £300 a day, so your charge will be £3 for every £300 withdrawn. Remember the fee is included in your maximum withdrawal, so if the fee is £5 you can only ask to withdraw £295.

As a rule of thumb, you should always opt to be charged in the local currency of the country you’re in! If you’re in Thailand choose Thai Baht, in Spain, Euros or in the United States, Dollars. If you choose ‘with conversion’, the ATM provider can apply their own exchange rate, which is not the live MasterCard exchange rates and I can almost guarantee the rate they give you will SUCK!

Being billed in your home currency may be convenient because you can get a good feel for how much something is costing you and whether it represents good value, but this Dynamic Currency Conversion comes at a price. When paying via DCC, you’ll often be charged at a much higher exchange rate for the privilege, often even claiming zero commission (but the real “commission” is the awful rate you’re getting). This is a complete waste of money and basically a scam. Always use the local currency.

Additional features

Starling

- Pays you interest on the credit balance on your account (0.5% up to £2,000 and 0.25% between £2,000 and £85,000) This is better than my Barclays account.

- You can apply for an overdraft (interest applies) up to £1000 which will allow to spend even when the money pre-loaded onto your card runs out.

- Starling is a fully licensed bank. You can, if you wish, pay your salary onto your card or ask friends and family to send money to your card using the standard sort code and account number format.

- You can also set up direct debits and standing orders to be paid from your Starling balance, because this is a ‘proper’ online-only current account.

Revolut

- Split your bill, if you have location turned on, it searches for those near you and you don’t even have to have their phone number, making payments a breeze.

- You can ‘Round Up’ your spare change on each of your transactions to make payments into your savings, so if you bill is £4.50 it will round it up to £5 and put the 50p into your savings and you could choose to put those savings into Cryptocurrency. Starling does have Round-Up on their future road map plans.

- You can see the current exchange rates with a progress chart, so you can easily see how rates are climbing or falling and add your favourites currencies on one page for a quick overview.

How to get hold of a travel card

I have been given invite codes, If you use them you might get signed up to their service a bit faster or get a free card, sadly there is no financial or freebie incentives for this, I just get a heart-shaped icon appear in the app. Please be awesome and use my code to pass on the heart shaped love haha!

You can get access to an Starling account by using this referral code: Y2F0MJBR

https://www.starlingbank.com/referral/?token=Y2F0MJBR

Get your Revolut card! https://revolut.com/r/ashley1hu

Conclusion

I will carry on using both of these cards, however Starling will be my go to for everyday use and I shall just be using the Revolut with the £200 limit on as an emergency back up incase god forbid I misplace the Starling card. Plus Revoluts app is very handy for checking the going rate.

If you found this helpful please follow my social media channels